What is Customer Lifetime Value (CLV)?

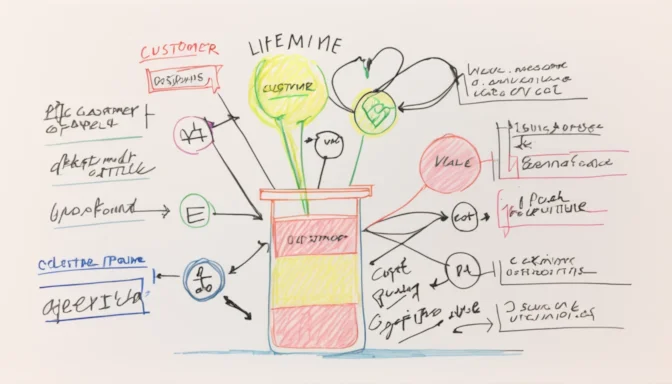

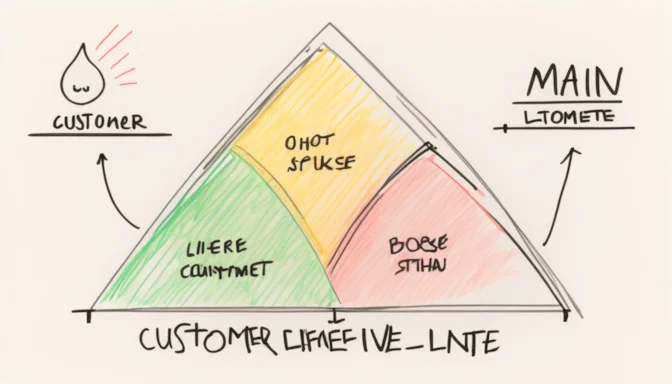

Customer Lifetime Value (CLV or CLTV) is a key business metric that quantifies the total net profit a company expects to earn from a customer throughout their entire relationship. It serves as a significant indicator for both short-term and long-term marketing and financial strategies.

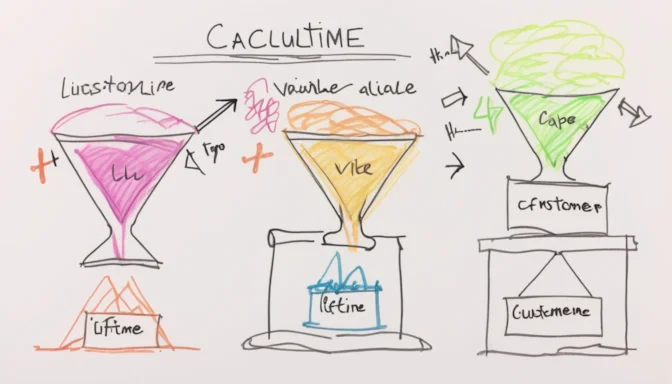

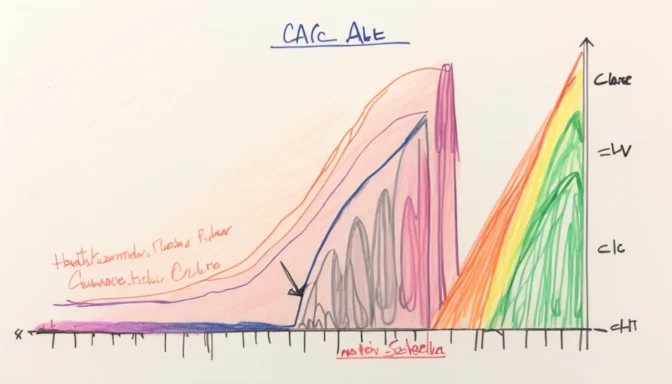

How to Calculate CLV

Customer Lifetime Value can be calculated using various formulas. A commonly used formula is CLV = Average Transaction Size x Number of Transactions x Retention Period. It's vital for customer support and success teams to understand this metric, as retaining an existing customer is often less expensive than acquiring a new one.

Example of Calculating CLV

For instance, if your total monthly revenue is $20,000 and your Cost of Goods Sold (COGS) is $8,000, your gross margin would be $12,000. You could then use this figure in the CLV formula to get a more precise value.

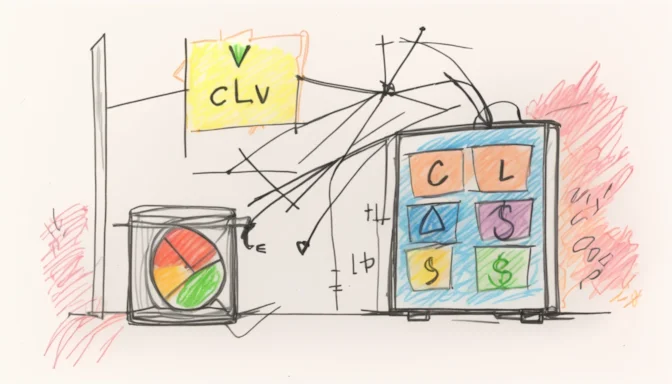

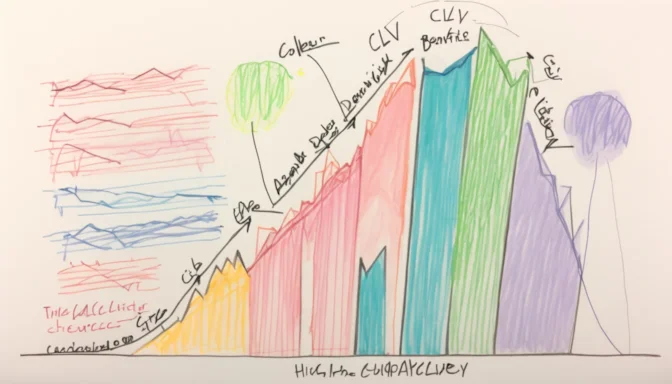

Understanding CLV Ratio

The CLV to Customer Acquisition Cost (CAC) ratio is an important indicator of business health. A CLV : CAC ratio of 3 or higher is generally considered healthy, reflecting effective product pricing, low churn rate, and a solid business model.

Why Calculate CLV?

Calculating CLV helps balance short-term and long-term goals and offers a clearer understanding of the financial return on marketing investments. It assists in making better decisions about customer acquisition and retention strategies.

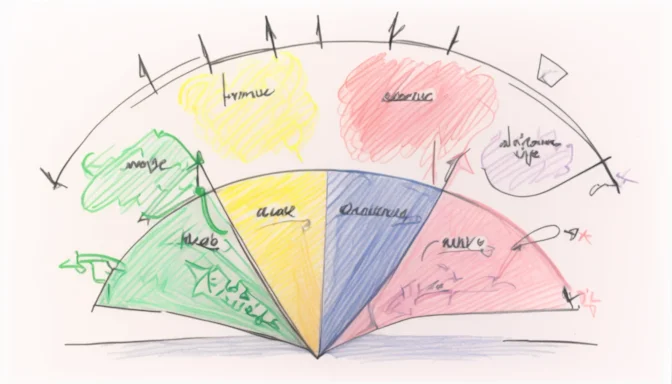

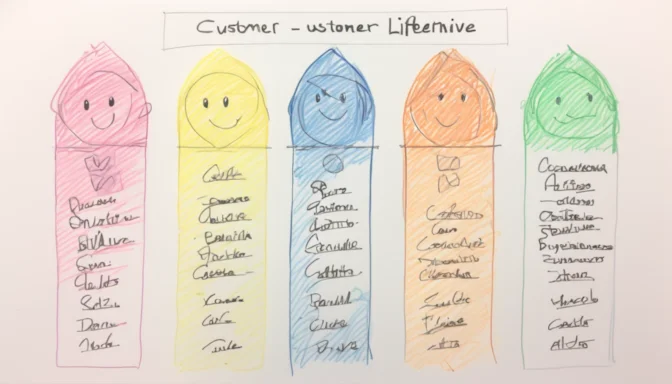

Components of CLV

The three primary components of CLV are customer acquisition costs, customer retention costs, and customer profitability. Understanding these components is crucial for optimizing your business strategy.

Should Your CLV Be High or Low?

A high CLV is desirable as it indicates strong brand loyalty, recurring revenue, and financial viability in the long term. High CLV can also lead to reduced customer acquisition costs and increased word-of-mouth referrals, thereby contributing to business growth.

E-Commerceo

E-Commerceo